- It's Pronounced Data

- Posts

- Are You a Software Company or a Data Company?

Are You a Software Company or a Data Company?

Hint: You’re Not Both

Nearly every company that touches data eventually runs into the same identity crisis:

Are we selling software? Or are we selling data?

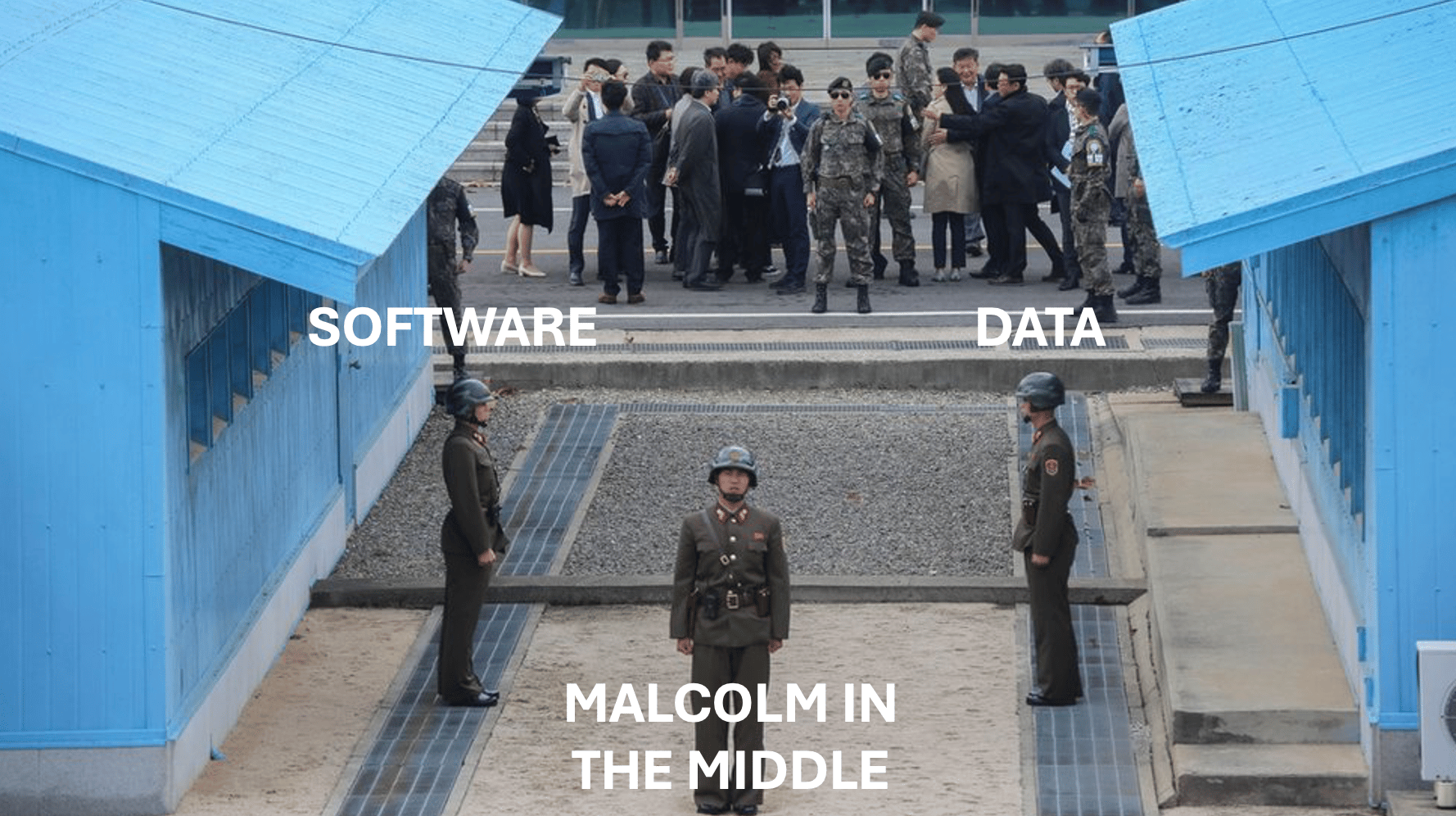

Internally, this shows up as tension between the platform product team who wants to build better capabilities (with a sprinkle of this thing called AI) and the data product team who wants to maximize revenue from the data content itself (also, maybe, with a dash of that thing called AI). Their success remains measured by two different, at times conflicting, metrics. One looks at users (DAUs, MAUs, seat licenses) and the other looks at either hard $$ or data consumed (bits and bytes).

Externally, this shows up as pricing that makes customers ask “wait, why does it cost that much to download what I can already see? Don’t they want me to be successful with the data and integrate it into my workflow?” (quick answer: nope, they want you to integrate it into their workflow).

It’s a deep rooted structural distinction, and most companies try to dodge it by pretending they’re both. They’re not.

The Core Conflict: UI Value vs. Data Value

Software companies monetize user experience, workflow efficiency, collaboration & communication, features, speed, and convenience.

Data companies monetize ownership, exclusivity, rights, distribution, reusability, and portability.

Those are different business models. When you claim to be both, you end up with a beautiful UI that customers only tolerate because they need the data. It’s the oldest trick in the data industry: make data cheap to view, but expensive to extract.

As a customer, you’ve seen this movie before. A user can query, chart, filter, visualize, export screenshots, and build models inside a platform. But the moment they ask for a bulk download, API access, cloud delivery, or in some cases even a basic csv…the price jumps. Not by 10%, by multiples.

I’m intentionally not going to name companies here, but I think you’re all thinking about your financial data platform, your founded pre-2021 company screening and deal sourcing platform, and your contact data provider.

The Internal Strain

I’ve seen this get to an extreme where the org structure was designed with a critical flaw. The information delivery mechanisms were P&L owners. Data Feeds & APIs was a business unit separate from UI which was also its own business unit. A multi-month sale where the UI was used to demonstrate the value could conclude with the client asking:

“can I get this via API?”

Sounds like a pretty simple ask, but the ripple effect this causes internally is anything but simple. At this point, the entire revenue recognition would move from one business unit to the other, ignorant to time spent, revenue targets, and what the real value to the client was… the underlying data, not the delivery mechanism.

When was the last time you paid attention to who delivered your Seamless or DoorDash order? Or even how it got there whether it was via a bike or a car? You weren’t buying the delivery mechanism, you were buying the meal itself (data) from a restaurant (data provider) of your choosing.

Markets Move First, Tools Follow

I’ve never loved the term disruptor. Not because it’s wrong, but because it’s usually lazy and applied to any startup in any industry. Most so-called “disruptors” aren’t dragging a market somewhere it didn’t want to go. They’re not prophets. They’re not rebels. They’re not forcing change onto unwilling participants.

What they’re actually doing is enabling a direction the market has already chosen. The demand signal is already there. Customers are frustrated, workflows are inefficient, pricing is opaque, access is gated, rights are unclear, and integration is painful. Innovation doesn’t create that demand, it reveals it and removes friction.

Calling these companies “disruptors” implies they’re destabilizing something healthy. In reality, most are exposing structural inefficiencies that everyone quietly agreed were broken but tolerated because “that’s just how it works.”

Enablement, Not Disruption

In the context of software vs. data, the real shift isn’t from old to new or from incumbents to startups. It’s from controlled access → portable access, UI-bound → infrastructure-led, seat-based consumption → system-level integration, and vendor-defined workflows → user-defined workflows.

The companies pushing this forward aren’t saying “throw everything out.” They’re saying “The market already decided this data should move more freely, we’re just making it possible.”

Who Wins, Who Loses

I’m not on LinkedIn preaching “SaaS is Dead” (or anything being dead for that matter, as rarely do companies disappear overnight). I do however think there are too many companies caught in the identity crisis noted above, and unfortunately too many more companies that don’t actually have a strategy. It’s probably less than 10% of people that I speak with, executives included, who believe their company has a real strategy right now. It’s dark. Maybe that’s why my job board is so popular?

I’m also not going to call out specific losers, but I don’t really need to, as in the case of the public ones, the market has already done so, with most down 40%+ in the past 3 months. But I will call out some winners.

The Companies Actually Enabling the Market Forward

A few companies sit right at the center of this shift, not by loudly declaring themselves the future, but by changing how data moves, both from a technical standpoint and with new commercial models.

Bobsled enables data companies to stop pretending distribution is a “feature” and start treating it like required infrastructure to serve clients. They help companies distribute their data across all cloud platforms and also recently launched the capability to build agents that answer sophisticated questions from complex datasets in seconds. Both capabilities have removed friction from the data sales process, as sales teams no longer need to file tickets for custom data pulls or sample queries, or tell the prospect “we’re working on Snowflake, it just might be 6 more months.” One of the best parts, Bobsled frees up technical teams to build new products and incorporate AI capabilities. With clients including CoreLogic, Deutsche Borse, Dun & Bradstreet, LSEG, and ZoomInfo, Bobsled has fast-tracked data delivery across cloud platforms to exactly where end customers wanted it.

Carbon Arc sits at the intersection of discovery, licensing, and reality. Finding, evaluating, and licensing data shouldn’t feel like swimming in the open ocean with no land in sight. The market already wanted faster discovery, clearer pricing, and less sales theater. With clients including large hedge funds, the Florida Panthers, Paychex, and Wasserman, Carbon Arc didn’t invent that desire, they operationalized it. The company also recently launched “Ask AI”. Check out their white paper here.

Brickroad leans directly into a dislocation of buyer and seller behavior. In the AI arms race, foundational model companies are spending hundreds of millions (if not billions) of dollars on data for training. From a buying standpoint, the needs are different than someone running analytics on a specific company’s performance (i.e. a hedge fund). There’s multi-modal data including images, audio, video, social, and more. The AI researchers aren’t data sourcing specialists, and the data sales teams are ill-equipped to sell to this persona. Brickroad connects the two, providing sourcing, transparent pricing, rights management, delivery mechanics, and governance, with clients including OpenAI, DeepMind, Turing, and Meta. Check out their thesis here.

OpenBB is a great example of how the UI vs. data debate is evolving. Users want composability, analysts want flexibility, and workflows shouldn’t be dictated by licensing artifacts. OpenBB has built the AI workspace for finance, with end-to-end solutions for AI experimentation and deployment. I saw a demo at a quant finance event where OpenBB connected to Carbon Arc’s MCP server to perform investment analysis on retailers using card transaction data, a dataset that was historically one of the most costly to license, wrangle, and analyzed. I was blown away and haven’t seen anything even remotely close from the large incumbent financial platforms. OpenBB reflects a broader shift. The interface is becoming optional, but access and interoperability are mandatory.

In Conclusion

If your moat is really data, pretending you’re a software company weakens your strategic story, and the road ahead for metrics looks awfully painful.

Does your pricing spike when data leaves the UI? If your customer wants the data outside your UI, do you smile? Or do you panic? If you panic, you’re not selling software, you’re selling data, your management team just hasn’t aligned a strategy on it yet.