- It's Pronounced Data

- Posts

- Newly Released Market Map

Newly Released Market Map

We may release more after review

Since last post we’ve seen 3 M&A deals, 7 funding rounds, 4 people moves & promotions, 3 roles, 1 Excel champion, 2 competitions, and 2 articles.

I wrote about the Clearwater Analytics deal in the newsletter and posted about it here.

Plus, last edition’s top clicked link. And after years of review and moving through the system, we are please to release an updated Market Map.

This week’s newsletter is brought to you in partnership with Masterworks. Check out their info below and please click their links to learn more (it funds this newsletter).

Investors see ANOTHER return on Masterworks (!!!)

That’s 3 sales this quarter. 26 sales total.

And the performance?

14.6%, 17.6%, and 17.8% → The three most representative annualized net returns.

(See all 26 at Masterworks.com)

Masterworks is the biggest platform for investing in an asset class that hasn’t moved in lockstep with the S&P 500 since ‘95.

In fact, the market segment they target outpaced the S&P overall in that time frame.*

Not private equity or real estate… It’s contemporary and post war art. Crazy, right?

Masterworks investors are typically high net worth, but the point is that you don’t need to be a capital-B BILLIONAIRE to invest in high-caliber art anymore.

Banksy. Basquiat. Picasso and more.

80+ of the world’s most attractive artists have been featured.

511+ artworks offered

$67.5mm paid out as of December 2025

$2.3mm+ average offering size

Looking to update your investment portfolio before 2026?

*Masterworks data. Investing involves risk. Past performance not indicative of future returns. Reg A disclosures at masterworks.com/cd

M&A

Clearwater Analytics (investment management platform) was acquired by a Permira and Warburg Pincus-led investor group for $8.4B.

Real Estate Business Analytics (REBA) acquired Markerr (rental market analytics).

Trading Technologies acquired OpenGamma (derivatives margin analytics).

*Deals are announced but may not be closed.

Funding

AIR (credit intelligence) raised $6.1M in a Seed round led by Work-Bench and Lerer Hippeau.

Cordulus (weather data) raised €6.8M in a Series A led by Delphinus Venture Capital.

Databricks (data and AI platform) raised $4B at a $134B valuation in a Series L led by Insight Partners, Fidelity Management & Research, and J.P. Morgan Asset Management.

FINNY (financial advisor prospecting) raised $17M in a Series A led by Venrock.

Repsense (media analytics) raised €2M in a Seed round led by Tensor Ventures.

Transparency Analytics (private credit risk analytics) raised a round led by Deciens Capital.

Woodway Assurance (data assurance platform) raised $1M in a Seed round led by Aventure Capital.

People Moves, Promotions, and Appointments

Josh Cubell was promoted to Head of AI Integration Strategy at Nasdaq.

Debbie Lawrence joined the Board of Directors of BattleFin.

George Watson was promoted to Managing Director at Raymond James.

Balaji Yelamanchili joined Dataminr as President & COO.

*may not have started roles, but roles are announced or updates provided online.

Competitions

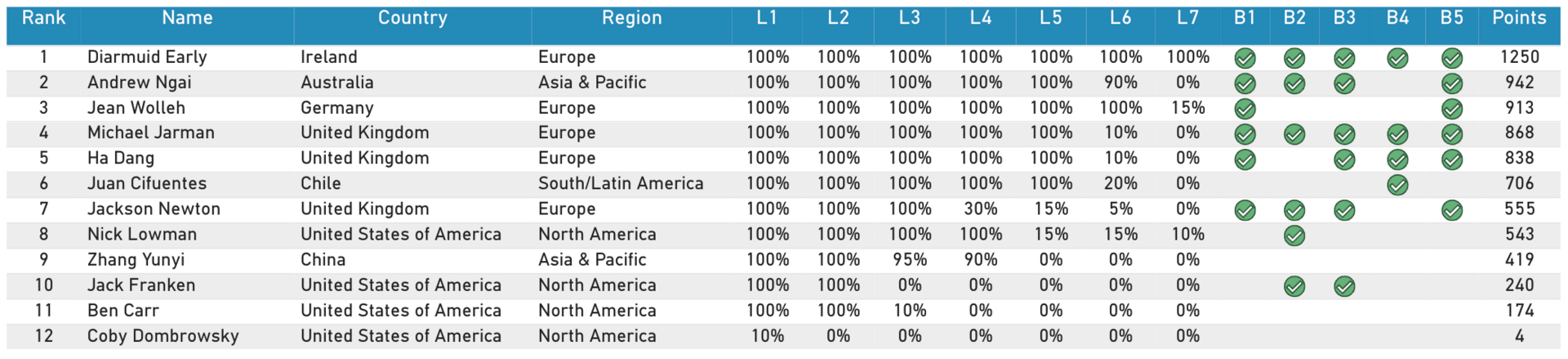

Congrats Diarmuid Early on winning the 2025 Microsoft Excel World Championship (yes, that is is thing). Check out coverage from the BBC’s Jamie McColgan in the article, 'LeBron James of spreadsheets' wins world Microsoft Excel title. Think you have what it takes to win? Sign-up for the 2026 competition here.

Speaking of competitions, BattleFin’s New Provider Showcase Competition is live with applications open.

If you provide data or analytics that help investors see financial performance before it shows up in earnings, we’d like to hear from you. Please apply by Dec 29th, 2025 with a short description of your dataset(s), coverage, delivery methods, and any additional information that describes potentials insights from the data.

A team of experts will vet the final group and review the detailed product profiles based on the specified criteria and score them by Jan 5th. The top 3 providers will be invited to pitch their products to a panel of data experts and buy-side audience at the upcoming Miami data conference. The data experts will score each one and announce a winner who will get a complementary data table, worth $12,500 at the next BattleFin conference.

Somehow I made it onto the “expert” roster 😁 I’m looking forward to evaluating new datasets and providing some “hot takes” on the industry alongside (real experts) Jason DeRise and Michael Watson.

Who’s Hiring

Antenna is hiring a Director, Insights & Analytics ($175K - $225K).

Fitch is hiring a Head of Data Sources and Acquisition Strategy, Senior Director ($210K - $260K).

Nasdaq is hiring a Lead Product Manager, Alternative Data ($106K - $148K).

*salaries only listed where provided by the company and may vary based on location and other factors. See links for specific salary details.

Resources

Deal Tracker for full M&A and funding rounds.

Job Board for full listings. This week’s additions are below.

Market Map PDF, PNG, and Spreadsheet.

Compensation Study Summary. Participate here.

What I’m Reading

Upcoming Events

*new events added since last newsletter

Insights Association CEO Summit, Jan 20-22, Hollywood, Florida

Data Products & platforms Summit, Jan 21-22, London

BattleFin Discovery Day, Jan 21-23, Miami

Data Day Texas, Jan 24-25, Austin, Texas

Samplecon, Mar 16-18, Lake Oconee, Georgia

QuantVision 2026: Fordham’s Quantitative Conference, Mar 19-20, NYC

Future Alpha, Mar 31-Apr 1, NYC

AI in Finance Summit, Apr 15-16, NYC

World of DaaS Summit, May 7, Washington D.C.

Monetising B2B Information & Events 2026, May 13, London

Favor

If you’ve read this far, please click here (always testing out some readership analytics) and connect with me if we’re not already connected!

Views here are the author’s own and not of any employers or companies. The author may be compensated for pieces in this newsletter.